In the next iteration of our “Simplex Ventures Founders Series,” let’s meet SympliFi, a fast-growing cross-border digital lending platform that works to facilitate access to affordable capital for micro, small and medium-sized enterprises (MSMEs) in emerging markets.

A Q&A with SympliFi, and its CEO and Co-Founder, Maurice Iwunze

Maurice, hello! Can you state your role at SympliFi and give a short description of the company?

I’m the CEO of SympliFi. We are a credit-as-a-service platform that provides credit on-demand to underserved businesses in emerging markets.

You have an extensive background working in banking and fintech, and notably have spent much of your career focusing on improving world-wide financial inclusion. We’d love to hear a little bit about your journey as a founder and the problem you are solving with SympliFi.

Prior to starting SympliFi, my co-founder and I worked together for 4 years building microfinance banks across Africa and China. We experienced first-hand how access to micro credit for productive uses can transform people’s lives. But the complex and analog way credit works today in emerging markets made it impossible to scale that product and its impact, which has led to a $5 trillion credit gap and millions of businesses unable to access the capital they need to grow. So, we ultimately started SympliFi to modernize the way credit works for business in these markets and make it cheaper and more accessible, at scale.

Who are SympliFi’s target customers? Where are you geographically focused now and where are you looking to expand in the future?

We are targeting micro and small entrepreneurs in emerging markets, starting with Africa. We are operating in Kenya, Rwanda and Nigeria. We are looking to expand to 2-3 more countries in Africa and then will explore expansion opportunities in Latin America and South Asia.

Can you tell us what types of loan products SympliFi offers?

We have three products: earned wage advances for gig and salary workers, inventory financing for FMCG retailers, and a secured working capital product.

At its core, SympliFi’s value proposition is its ability to increase financial inclusion by enabling greater access to credit in emerging markets. What is the market opportunity you are creating, both at the level of the individuals you are financially enabling and at a macro level?

What Google was able to do for information and Uber for transportation, we aim to do for credit – enable anyone to access it on-demand, regardless of where they live.

From our experience, most businesses in these markets just need access to small amounts of working capital for short periods of time. It goes a really long way for their business. We enable instant accessibility, on-demand, at a much lower interest rate. Its transformational. In only a short period of time, 82% of our users in Nigeria reported an increase in income and 75% said their quality of life has improved. At a macro level, these businesses are the backbones of economies. Their growth fuels the growth and prosperity of the broader economy.

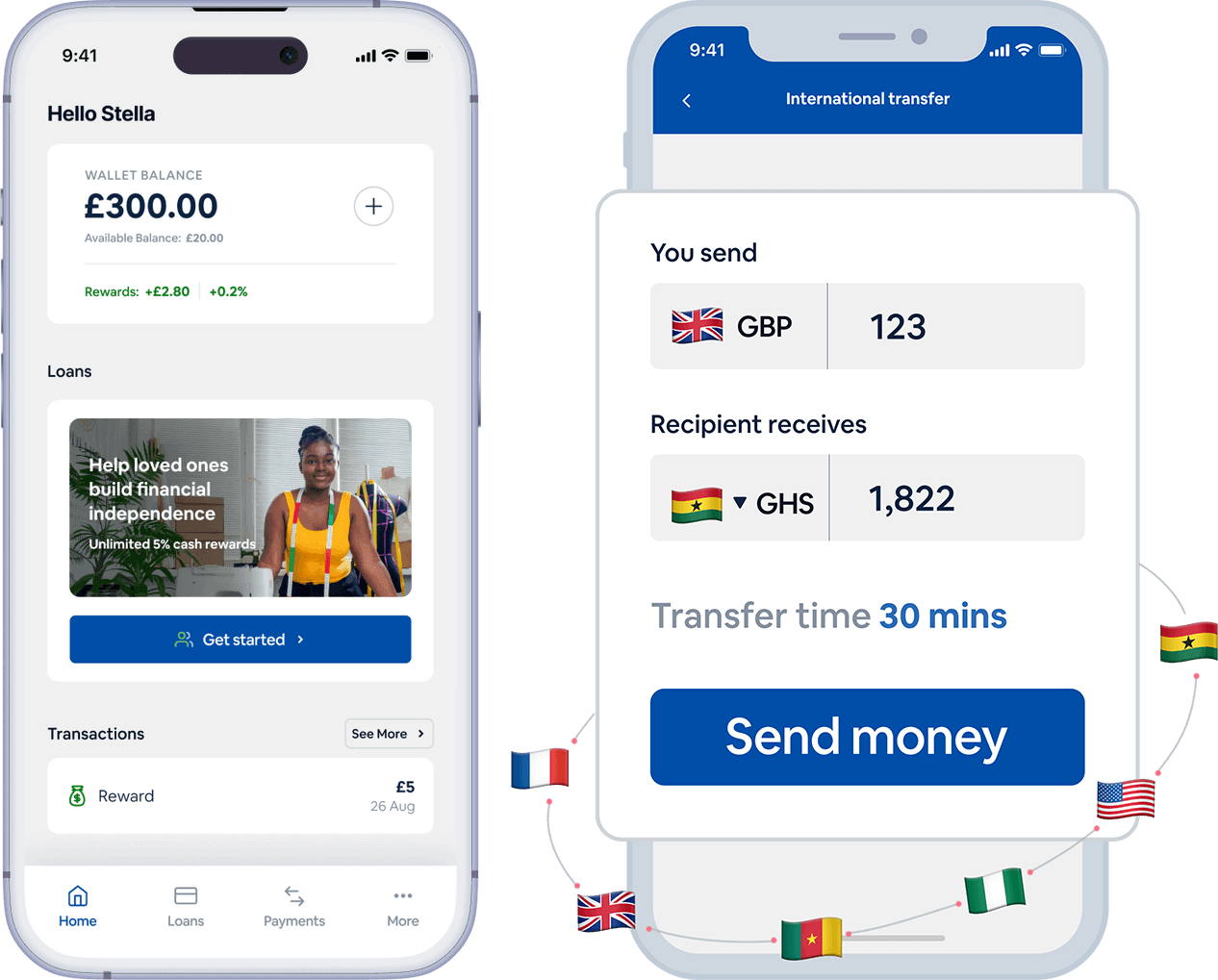

The SympliFi app offers a simple, seamless experience to digitally connect lenders, guarantors, and borrowers back home. All of this is fee-free and builds in a lower interest rate for borrowing – a win-win solution. How does the app work to provide this end-to-end credit experience?

This is a unique feature of our platform. In markets with low credit penetration, you are going to have borrowers who may not yet have the right profile to access credit. As we are fully digital, we pioneered a way to enable those borrowers to start building their credit responsibly, by utilizing friends and family anywhere in the world to serve as digital guarantors for them through the SympliFi app.

It’s a fairly simple process. A borrower in Nigeria for example, can use their relative in America as a guarantor for a loan. Their relative in America downloads the SympliFi app, tops-up their wallet with a small refundable deposit that secures the loan, the deposit is held in the wallet in the US earning interest, and now the family member in Nigeria can instantly access credit on our platform, anytime they need cash. The guarantor earns money for helping, the borrower gets instant access to credit at much lower rates, and starts building their credit history. It’s a win-win.

We’d love to hear a success story for SympliFi that you’re currently really excited about.

There’s lots. But I think a specific story that excites me is a small restaurant owner in Kenya that uses our product. She’s a single mother that uses SympliFi to buy goods for her business. She told us that because she’s now able to access credit to fund her business, it freed up cash that she could use to pay for her daughter’s school tuition. She no longer had to choose between funding her business and sending her daughter to school. That’s the impact we are delivering. Something as simple as helping a business owner better manage their cash flow has a profound affect on their lives in many ways.

Looking towards SympliFi’s future, where do you see the company growing?

Similar to Klarna, we want to be a simple credit plug-in for small businesses in emerging markets that are rapidly digitizing. We want to be the fuel that powers their growth. We are starting in Africa but are building a global platform.

Where can people find you to learn more?

They can learn more about what we do at https://www.symplifi.co/about-us and follow us on Linkedin at https://www.linkedin.com/company/symplifi/