The next portfolio company we’re highlighting in our “Simplex Ventures Founders Series” is Eko, whose ‘Investments as a Service’ solution enables financial institutions to offer digital investments directly on their existing banking platform.

A Q&A with Eko, and its Founder and CEO, Mart Vos

Welcome, Mart! Can you kick us off by giving a quick introduction of yourself and Eko?

I’m from the Netherlands, but currently reside in NYC. Prior to Eko, I worked in the hedge fund world; however, we were not a traditional hedge fund in which you have one strategy and the client subscribes to strategy. Instead, we create personalized strategies and portfolios for every client. My previous experience has quite a bit to do with what I’m doing today. Eko enables financial institutions to offer digital investments directly to their existing banking platform. I like to say Eko is an investment product in a box. That is, an investment product without having to build it yourself or hire any outside help.

As a white label investing service for community banks and credit unions, what problem is Eko built to solve?

The problem is most Americans prefer to invest their money with a trusted financial institution, but if their preferred institution doesn’t offer it, they’ll find it somewhere else. In the Netherlands, it’s very common for people to invest their money within their one, well-respected bank. But, in the US, there are 10 different bank options. So, how do you choose? Without any effort from a bank or credit union, they’re able to offer digital investing with Eko.

Take us back to July of 2020. What inspired you to start Eko?

In July of 2020, I saw a huge gap in the way individuals invested with their banks and was inspired to create a product that would close this gap. Eko launched at the perfect time – what once was a “nice to have” in terms of digital investing is now a “must have” for consumers.

Eko is a win-win for both community banks and credit unions, as well as their millions of customers. Can you explain the value-add for both the banks and credit unions, as well as the consumers who bank with them?

With Eko, banks and credit unions can stand out from the competition and attract younger clients. The platform is also able to create an additional revenue stream and increase client ‘stickiness’ for them.

For the end clients, it’s simple. They can now invest their money with the bank they know and trust without having to make a new account – all on the same app. Forty-five percent of Americans don’t invest as they find it too intimidating. With Eko, they can now get started for $10 on the same banking platform they are already using.

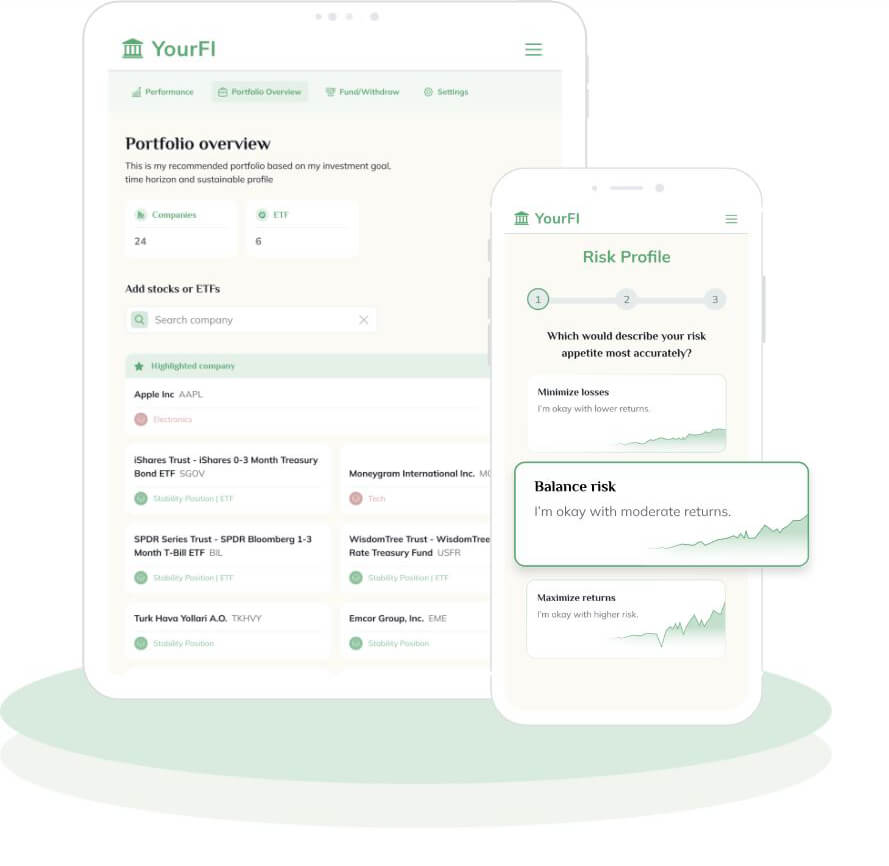

With Eko’s integrated investing platform, how can consumers customize their investment portfolios to align with their investment goals and interests?

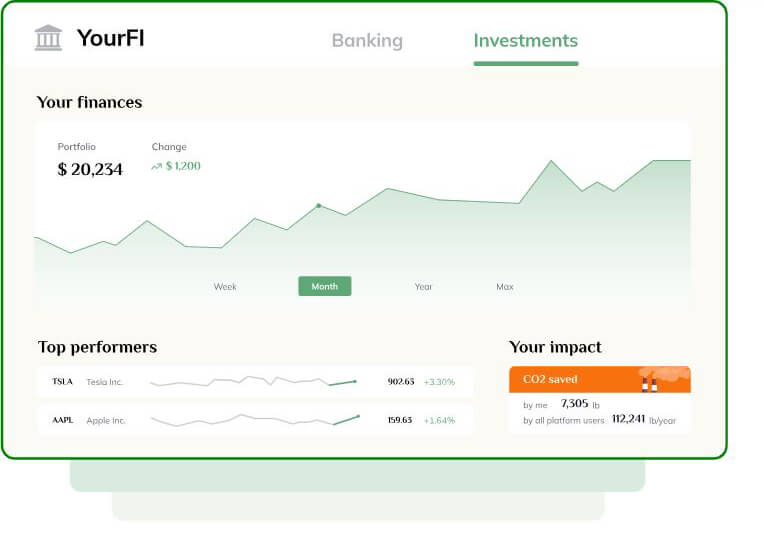

We started an investment product where we create a portfolio based on you and your interests. Each user gets a personalized portfolio based on risk level and investment goals. Within the dashboard, Eko automatically connects consumers’ banking and investing accounts so they can seamlessly fund their accounts or send money the other way. Additionally, Eko monitors users’ portfolios, while giving access to engaging dashboards showing their live performance.

Overall, this strategy allows for clients to add and/or remove holdings at any time, allowing for flexibility when you need it, but also gives guidance. This model is very unique as it’s quite complex to build, and it’s one that I haven’t seen before.

A notable component of Eko’s platform is its adaptability and easy integration. How long does it take to connect Eko to a credit union’s existing online platform?

By choosing Eko, it takes as little as three to four weeks to fully integrate to an existing online platform. We have partnerships with digital banking providers, and via these partnerships we can easily distribute our product. For example, one of our partners is a digital banking provider with 700 clients. Now with one integration into this digital banking product, we can sell to 700 banks/credit unions, without ever having to integrate again.

What are some of the key features that Eko offers credit unions and community banks as they look to adopt the platform?

The product itself and the ability to offer a next-generation investment solution – within four weeks and without hiring anyone or building anything – to all their clients, not just the one percent.

We’d love to hear an Eko success story about which you’re currently really excited.

Initially, it was quite difficult to make the first sale. We worked tirelessly for five months, but no one knew us. They’d rather talk to existing clients. After months of consistency and hard work, we were able to sign our first client! Not shortly after, we signed a few more clients. Credit unions and community banks are excited about Eko because they have a market for the product. Now, we hear clients say this product alone will revolutionize their bank.

As Eko’s success continues, what are some areas where you see the company growing?

We are working very hard to recruit more clients and are on track to have a total of 10 clients by the end of 2023. We also want to help banks and credit unions market themselves. We’re really trying to make this as simple as possible for the client by providing them with white label marketing materials and investing in billboards and posters.

Where can people find Eko to learn more? Visit us online at https://eko.investments/.

+++

Since opening its venture capital arm, Simplex Ventures, Simplex Trading has invested in more than a dozen high-growth companies and funds – ideas that are shaping the future of finance. Through strategic investments, Simplex Ventures is creating collaborative partnerships with visionary founders of fintech companies who are driven to disrupt and transform the financial industry. Discover more information about Simplex Ventures and our portfolio companies.