In the next iteration of our “Simplex Ventures Founders Series,” let’s meet BluePallet, a B2B marketplace and network solution designed for the chemical industry, offering its members the opportunity to discover, connect, and transact based on the strengths of marketplaces and real-life networks.

A Q&A with BluePallet, and its CEO and Co-Founder, Scott Barrows

Hi Scott, welcome! To kick things off, can you give us a quick introduction and brief overview of BluePallet?

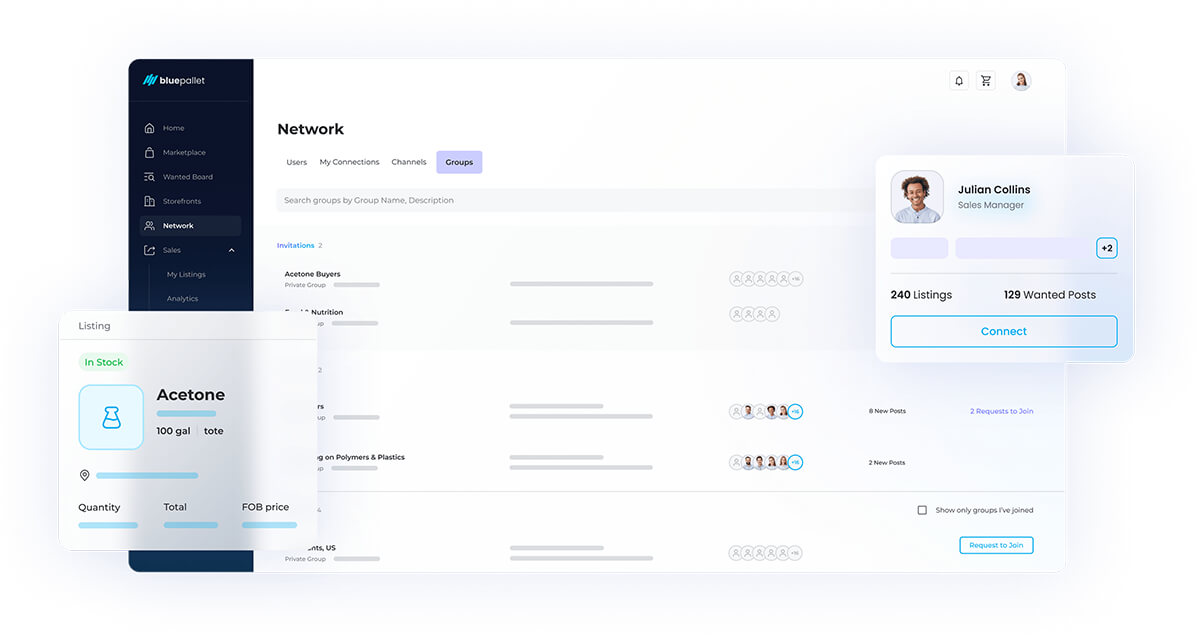

We are a B2B marketplace and network for the industrial chemical and ingredient industry. The “network” portion is what makes us special. Not only can buyers purchase indirectly from vetted sellers on our marketplace, but they can also create one-to-one connections (imagine LinkedIn + Amazon) between procurement agents and sales reps and do direct business with each other in a seamless and secure environment.

Scott, you have extensive experience founding and leading high-growth companies. How have your past roles paved the way for BluePallet’s success?

I was fortunate to build and sell a similar platform for the event ticketing industry six years prior. That industry was about 15 years ahead of my current one, so it has helped provide a road map for new solutions to bring forward and models to follow (and avoid).

Give us a bit of background on how BluePallet came to be. What is the inspiration behind the company?

It was actually a merger between our Marketplace platform and a B2B fintech company at the beginning of 2021. Both companies were almost acquired in 2020 to create a global platform for PPE but after the deal fell through it still made sense to both parties to come together and that is how BluePallet was born. Both sets of founders never met in person until almost six months after the merger. A true Covid story.

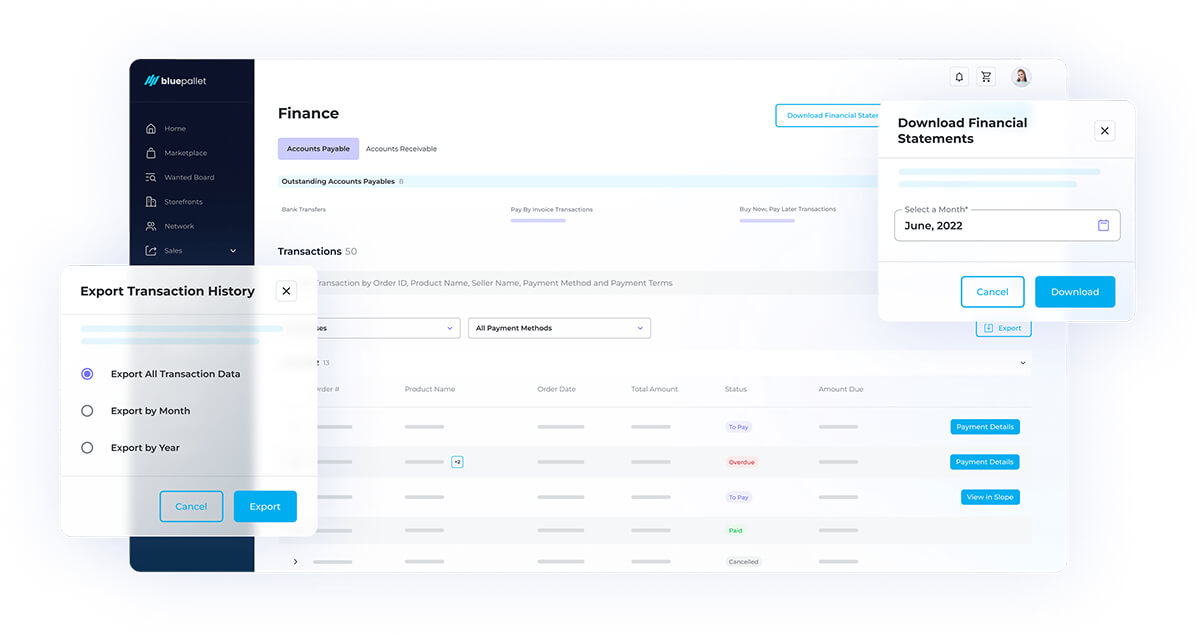

How are BluePallet’s fintech capabilities and established marketplace positioned to create e-commerce solutions for the chemical industry?

We start by conducting a “Know your Customer”/”Know your Business” (KYC/KYB) risk assessment and screening on every participant before allowing them on the platform. Once they pass our “TradePass” screening we verify and link their bank account which allows them to start doing multi-million-dollar transactions within a couple of clicks within our marketplace and with new trading partners that they discover and connect with on our Network. Our industry demanded a solution to have vetted participants and also do large end-to-end transactions domestically and internationally. Our fintech capabilities allowed us to check all of those boxes.

How expansive is the chemical shipment sector in the U.S., and what is your perspective on how it is evolving as an industry? What role is BluePallet playing?

The U.S. market for chemicals is roughly $500 billion. It is not one that fluctuates in size and typically its growth follows gross domestic product (GDP). Our platform won’t make the chemical industry double in size, but it will create immense efficiency, increase Earnings Before Interest, Taxes and Amortization (EBITA) for our members, and most likely create a market share shift for those that are early movers and adopters.

BluePallet offers a seamless and secure chemical buying experience through its TradeHub, TradePass, and TradeCart. We’d love to hear more about these offerings and how they facilitate the end-to-end process.

TradeHub is where you go to buy and sell industrial chemicals. TradePass was described earlier and involves a KYC/KYB risk assessment, screening and bank account linking, and TradeCart is the process that allows for a four-click check out of a full truck load of citric acid, for example, which includes the booking of freight and movement of funds.

Who are BluePallet’s customers, and what are some ways that BluePallet’s platform simplifies the trading process to enable transactions for both buyers and sellers?

The three buckets are chemical producers (e.g., Dow), distributors, and end users (typically manufacturers). What is unique about BluePallet is that we don’t define a company as a “seller” or a “buyer,” and we feel that is a mistake that other platforms make. Any company can come to BluePallet to buy or sell. Some of the world’s largest producers have been our biggest buyers. Our end users have been using the platform to sell overstock supply back to the marketplace instead of paying to have it disposed of. It is really interesting to see all the different ways that members use our platform, but it happens because we don’t force a specific flow for the transaction.

To date, what have been some of the largest transaction sizes on the BluePallet platform?

Our largest single transaction to date has been $318,000, which from my searching is one of the largest end-to-end transactions completed on any marketplace available today.

We’d love to hear a success story for BluePallet about which you’re currently excited.

We have one of the largest chemical distributors in the world bringing on their largest customer to do direct business together on our platform via our Network technology. For this distributor, this relationship was an existing piece of business worth $40 million a year that they are looking to grow to $100 – $150 million. Both parties saw and are seeing the value in utilizing BluePallet versus staying with a status quo arrangement. This scenario would never happen on another rival system.

Looking towards BluePallet’s future, where do you see the company growing?

We have built this from Day 1 to be scalable internationally. We have recently completed partnerships and integrations where we will be able to utilize international rails in Europe, Asia-Pacific and Latin America to move money and will be adding on logistics capabilities to complete the international TradeCart experience. Our risk assessment and screening capabilities recently expanded to international markets, as well.

Where can people find you to learn more?

Our new bluepallet.io website has a good amount of information, and you can also contact our Director of Marketing, Lauren Conte (lconte@bluepallet.io), to get added to the invite list for any future webinars on product releases.

+++

Since opening its venture capital arm, Simplex Ventures, Simplex Trading has invested in more than a dozen high-growth companies and funds – ideas that are shaping the future of finance. Through strategic investments, Simplex Ventures is creating collaborative partnerships with visionary founders of fintech companies who are driven to disrupt and transform the financial industry. Discover more information about Simplex Ventures and our portfolio companies.