Since opening its venture capital arm, Simplex Ventures, Simplex Trading has invested in more than a dozen high-growth and visionary companies and funds – ideas that are shaping the future of finance. Through strategic investments, Simplex Ventures is creating collaborative partnerships with visionary founders of fintech companies who are driven to disrupt and transform the financial industry.

Over the course of the next year, we’re going to meet each of these companies and founders in a new “Simplex Ventures Founders Series.” More information can also be found about our portfolio companies here.

First up – Lynk, and its founder and CEO, Nabi Awada.

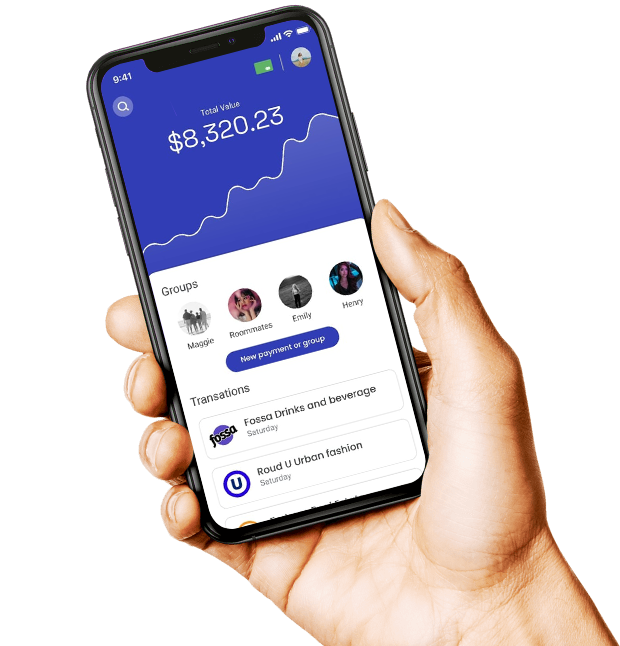

Lynk is a closed-loop payment and card issuing platform that reduces processing fees and creates a unified full-stack banking experience.

Welcome Nabi, tell us a little more about Lynk.

Hi. As a closed-loop payment and card issuing platform, Lynk enables our clients to monetize their brands, gain robust data insights and improves customer retention and acquisition while building new revenue streams.

Lynk is a win-win for both consumers and merchants, revolutionizing the payments space for many merchants and consumers. We’d love to hear you describe Lynk’s value proposition. What is Lynk doing to enable smaller marketplaces in democratizing access to financial services?

We believe payments don’t have to add friction and that commerce can be rewarding for all participants. We want to give the power back to merchants and improve the customer experience. Lynk allows merchants to save on processing and reallocate that towards customer rewards, benefiting everyone in the ecosystem.

What is the inspiration behind Lynk? What motivated you to start the company?

I come from a family of small business owners, so I’ve seen the impacts of high processing fees and low customer retention as my family struggled to keep their businesses afloat. As I started working at some of the most influential fintech companies in the world and became exposed to the inner mechanics of how other geographies have tackled these problems, I realized there must be a better way to do business.

I took my inspiration from the EU, LATAM & Asia, where entire closed-loop ecosystems have taken root, and I started to become more acquainted with the spectrum of financial products available in the US before landing on key solutions that make Lynk possible.

You came from strong financial and technology-focused backgrounds. What is your experience in the world of fintech?

Yes, I have over 15 years of fintech experience across a broad range of verticals and geographies.

Where is Lynk currently based? What markets does it serve?

We are located in Vancouver, British Columbia. However, we’re planning to open a headquarters in the US in early to mid 2023. Currently, we focus on the US and serve early and mid-stage venture-backed businesses in the marketplace, Software as a Service (SaaS), and gig economy spaces.

Lynk’s closed-loop platform allows companies to focus on what’s important – their products and services. What aspects of a merchant’s day-to-day business become simpler (or more effective) with Lynk’s platform?

Our focus is on three main pillars: customer loyalty, payments processing, and disbursements. We believe our product solves inherent problems in these three areas and provides a unified solution that increases average order value, gross merchandise value, and revenue while decreasing costs.

How much can Lynk save a small to medium-sized company?

Our unique approach allows businesses to save up to 90% on processing while making disbursement a revenue channel.

We’d love to hear a current customer success story!

One of our latest customers, which has over 50,000 users and is widely successful in terms of low-cost acquisition and daily active users numbers, still had not found a way to monetize their product. We chatted with them and within a few days, found a path for monetization using Lynk.

The best part? We had them in market with the solution in record time, blowing past their projections. At Lynk, we don’t just provide a product; we also support our customers and find ways to increase revenues or create new revenue streams altogether.

What are you most excited for in the next six months?

Since coming out of stealth, we’ve been inundated with inbound requests to use our platform, but this is just the beginning. We have some major products to release in the next six months that will fundamentally change how payments are made. So, stay tuned!

Where can people find you to learn more?

You can learn more about Lynk at trylynk.com; we’re also going to kick off a podcast about payments, growth, and the ever-evolving world of commerce in Q1 2023.